Call us 469-717-3607

Welcome to the SWBD family!

As your appointed agents, we are available to help you during the year with questions that may arise with your health or dental plan selections. Just a few ways we can be of service is helping with claims and billing issues, finding in-network providers and facilities, and requesting member cards.

We look forward to being of service to you and your family.

Step One

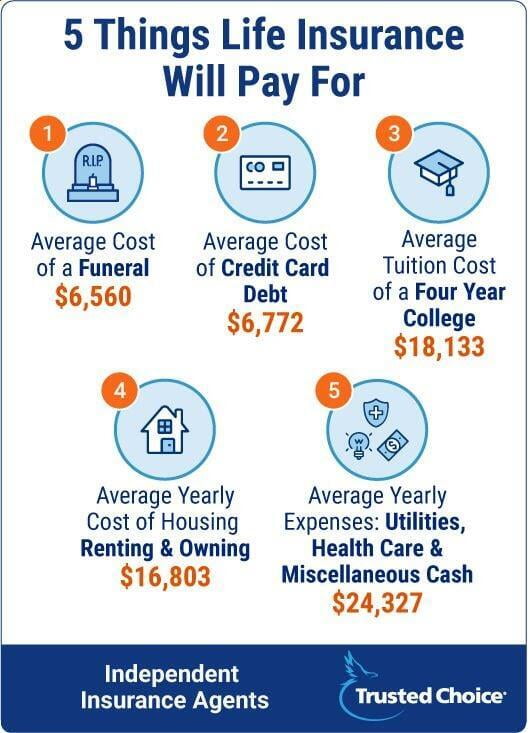

Add all the amounts for the following categories together

- Your annual income multiplied by the number of years your loved ones will need that salary. For example, if you make $50,000 and want to provide your family with that income for 10 years, you would need $500,000.

- Combine financial obligations, including your mortgage, credit card debt and loans.

- If you have children, think about your children’s future educational needs, including college

- Estimated final expenses, such as the cost of your funeral.*

*Forbes Magazine

Step Two

Subtract the amounts below from Step One

- Savings

- College 529 Savings

- Other life insurance policies

Things to Remember:

At-home parents, who may not have a salary but whose household contributions are critical, should estimate how much the family may have to pay for child care, house cleaning, and other services.

If you have life insurance through an employer, these policies are usually provided at no cost but offer limited death benefits and are connected to your employment. Once you leave the job, you’ll likely lose the life coverage.

sStep One - Step Two = Amount of Life Insurance Neededs

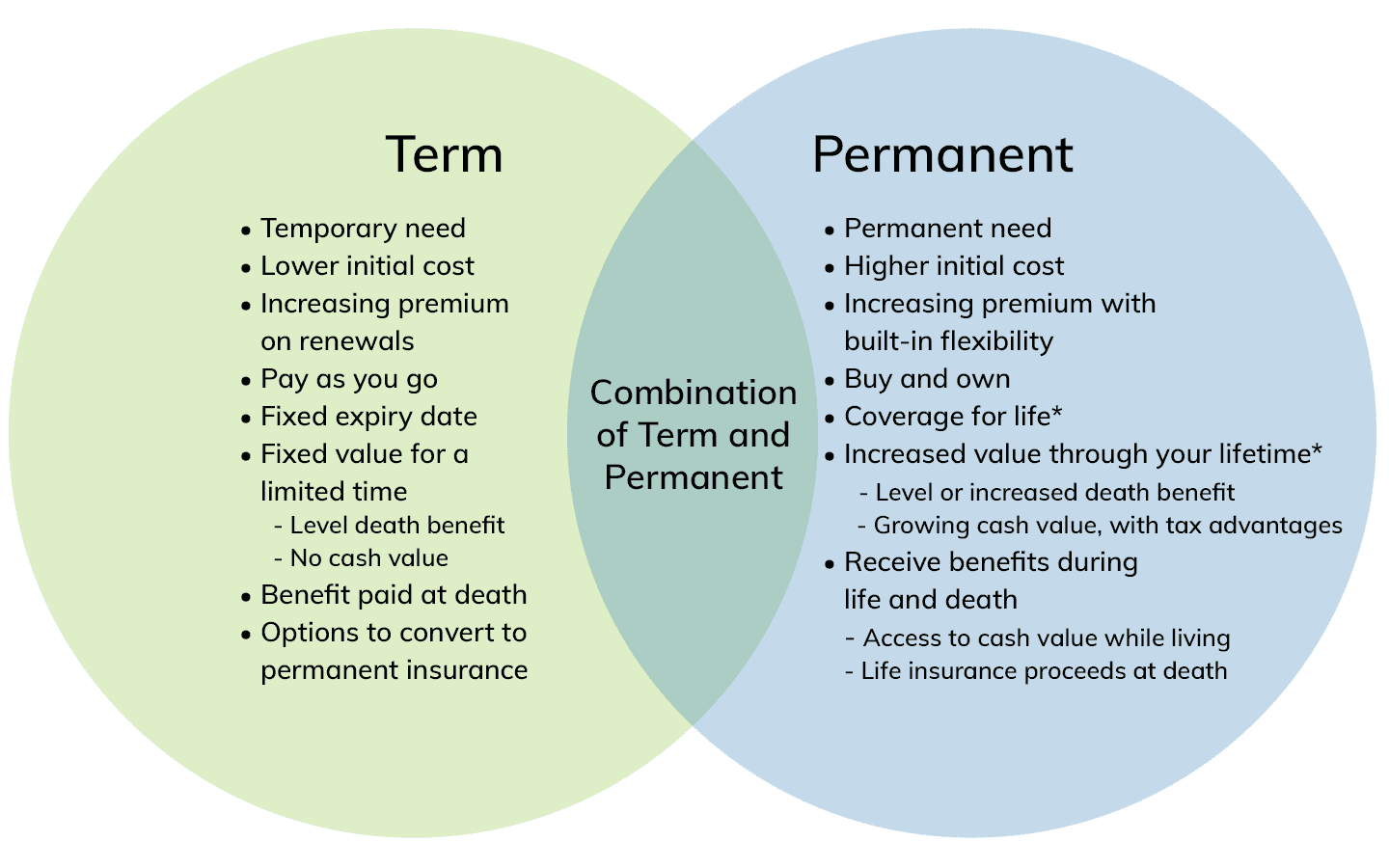

Types of Life Insurance - Term vs. Permanent

Combination: If you’re looking for the best overall solution, the decision of term versus permanent doesn’t have to be an either/or situation. Often, the best choice is a combination of both types of insurance. The key is finding a solution that matches your duration, insurance needs, and budget.

International travel is back!

Given recent epidemics, natural disasters and security threats around the world- coupled with your run-of-the-mill medical issues- travelers have more reason than ever to ensure their health and safety are fully insured prior to embarking on their trips. GeoBlue from Blue Cross Blue Shield is the gold standard for covering you and your family when your adventures take you overseas.

Pricing Varies From Pharmacy to Pharmacy

Pricing Varies From Pharmacy to Pharmacy

Consumers are often surprised to find that pricing is not customary across all pharmacies and can vary substantially from one pharmacy to another.

Several years ago Consumer Reports completed a pricing survey and found pricing can vary as much as 10 times between pharmacies, even within the same zip code. A number of factors determine how pharmacies price their drugs. This can include their business costs (overhead), profit margins, and prices charged by pharmaceutical companies. Generic drug pricing is a good example. Different manufacturers set their own pricing for the same generic drug, which is often priced low. This allows more price fluctuations between pharmacies as they set their own retail pricing.

It is important to find a pharmacy that has low prices on your medications, even if it is not your favorite pharmacy. If you have not shopped around you could be paying too much for your prescription drugs. There are several ways you can check to see if you are getting the best price.

- Call and ask the pharmacy for pricing

- Use an internet drug search tool such as GoodRx. If you use GoodRx, type in your zip code and prescription to see pricing in your zip code. This allows you to find the best possible pricing before you go to the pharmacy.

A few things to remember

- If you have insurance, your copay could be very different (and not always cheaper!) than the cash price. If the discounted price is less than your copay, you do not have to use your insurance copay.

- Brand name drugs are typically more expensive than generic ones. Talk to your doctor to see if you can use a generic version.

Finding the least expensive pharmacy to fill your prescriptions should not be hard and time consuming. In addition, you should not have to spend your entire life savings to get the medications you need.

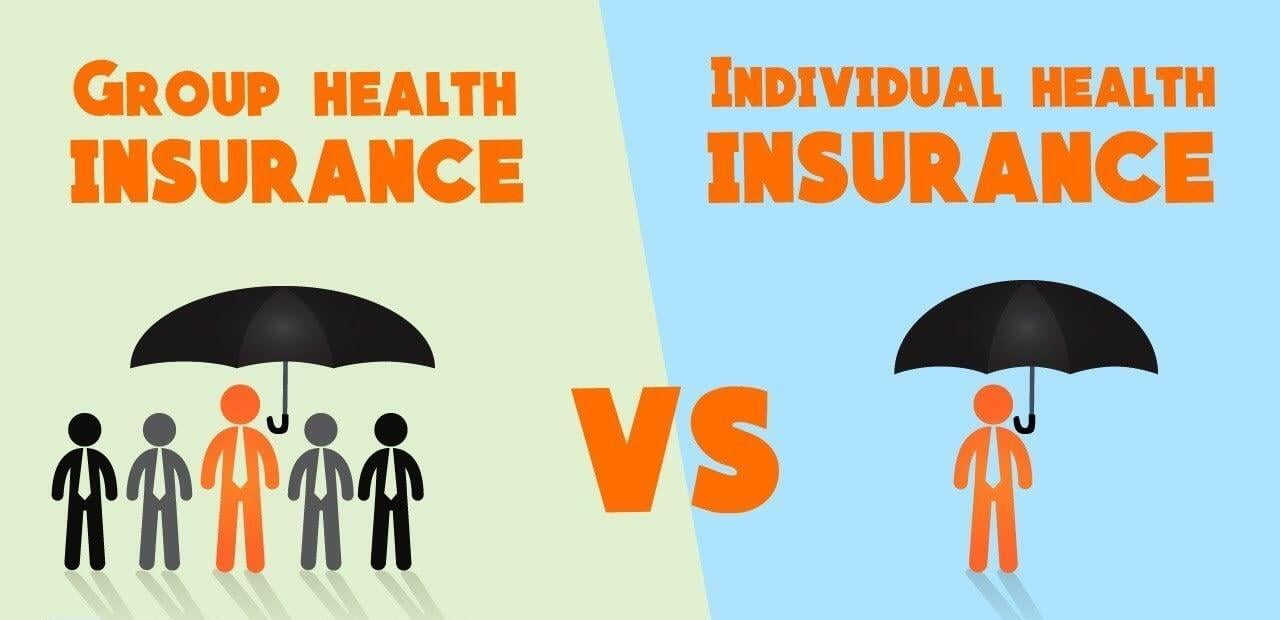

- Your employer does all of the work choosing the plan options

- Employer may offer only 1 or 2 plan choices

- Employer may contribute to the cost of the premiums for the employee, typically employers do not contribute to spouse/dependents costs

- Some employers do not offer coverage availability for your spouse/dependents

- Premium contributions from your employer are not subject to federal taxes, and your contributions are taken out of your paycheck on a pre-tax basis, which lowers your taxable income.

- Enrollment is during your employer’s open enrollment period

- Plans can cover just yourself or your entire family

- You can choose your plan from the Marketplace or a health insurance company

- You can choose the insurance company, the plan and the options that meet your needs

- You can choose a plan that includes your doctors and nearby hospitals

- During the annual Open Enrollment period you can renew or change health insurance plans

- Your plan is not tied to your job, so you can change jobs without losing your coverage.

- Premiums can not be paid with pre-tax dollars

- Premiums can be expensive because you have to pay the entire cost yourself

- You may be eligible for a subsidy from the government to purchase an Affordable Care Act-compliant individual plan. This can help save you money on your health insurance.

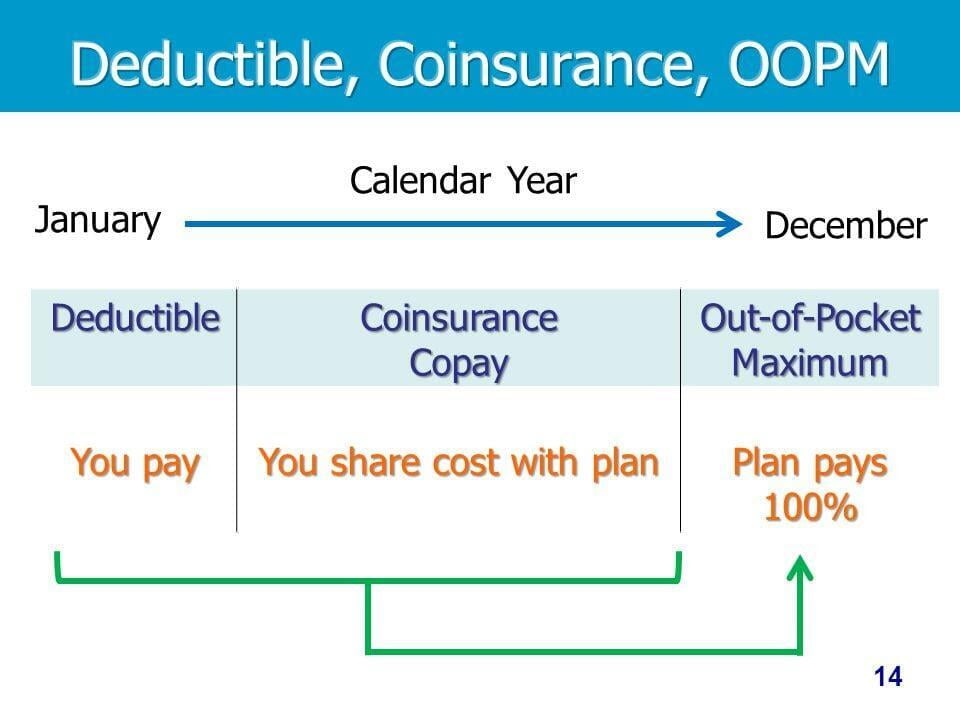

Health Insurance Terminology

How can you make the best decision for you/your family’s health insurance needs without knowing at least the basics? We want you to feel comfortable with making these important decisions, so the following are basic health insurance terms everyone should know. It will help you better understand your coverage and what expenses to anticipate when using the benefits of your health insurance coverage.

How to Manage Stress

Stress is the body’s response to the pressure and demands of daily life. Everyone at one time or another experiences stress. Our bodies react to stress with symptoms like elevated heart rate and blood pressure and changes in emotions. Prolonged stress does have negative effects on our bodies and can lead to mental health difficulties or physical health problems.

Here are a few ways to help relieve stress:

Here are a few ways to help relieve stress:

Move your body

Any physical activity can reduce stress and help your mood, even just a short walk or stretching.

Eat healthy foods

A healthy, balanced diet can help reduce stress. Stay away from caffeine, alcohol, or eating too much as these can increase the effects of stress.

Take a time out

Take time to relax and do something for yourself. Meditate, write in a journal, take a hot bath, etc. Taking care of yourself will help you feel less tense and overwhelmed.

Get enough sleep

The amount and quality of sleep can affect your mood, energy level, concentration, and overall functioning. If you have trouble sleeping, start a relaxing bedtime routine, listen to calming music, and try to maintain a consistent schedule.

For more information on the effect of stress and tips for relieving stress please read the articles from the WebMD andthe Mental Health Foundation.

What's an ER?

Today we are extremely fortunate to have Emergency Departments, Stand Alone Emergency Rooms & Urgent Care Clinics available to help us in our time of medical need. With that said though, they are not one and the same.

Below we will go through the basic differences so you can make the best decision on which facility will meet your needs.

Hospital Emergency Departments/Rooms:

This is the best option when you need immediate medical attention for severe illness or injuries. Emergency Departments are staffed 24/7 with physicians, physician assistants, nurse practitioners, and nurses trained in emergency care. The ER staff has immediate access to expert providers in advanced specialties such as Cardiology, Neurology, and Orthopedics. They also have all the imaging and laboratory resources needed to diagnose and deliver care.

Freestanding Emergency Rooms:

Freestanding ERs can treat the same conditions as ERs that are attached to a hospital. They can be owned by a hospital, a health system, or a private organization. The doctors, nurses, and other personnel tend to be private employees. They are staffed 24/7 and are trained in emergency care. Freestanding ERs usually have shorter wait times and different locations around town. Most people who visit a freestanding ER are considered "walk-in" patients instead of arriving by ambulance.

Urgent Care Clinics:

Urgent care clinics treat minor illnesses or injuries that just can't wait until tomorrow. They are generally staffed with physicians, physician assistants, nurse practitioners, and nurses. They can order basic labs and imaging tests, such as X-rays, to help them provide diagnoses and develop treatment plans, but do not have the exhaustive resources as the Emergency Department. As a result, Urgent Care clinics often are less expensive, have shorter wait times, and have multiple convenient locations such as nearby shopping centers and commercial plazas.

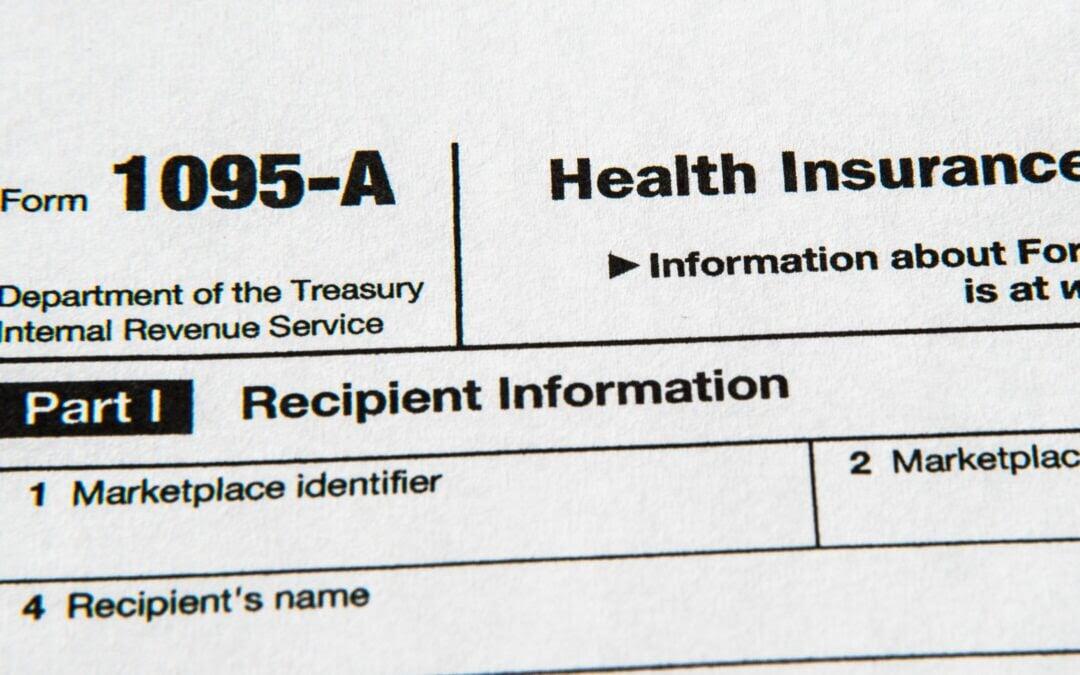

It's Tax Time!Your Form 1095-A

Member Quick Start Guides

If you do not see your carrier, please call us or if you need additional help with member setup.

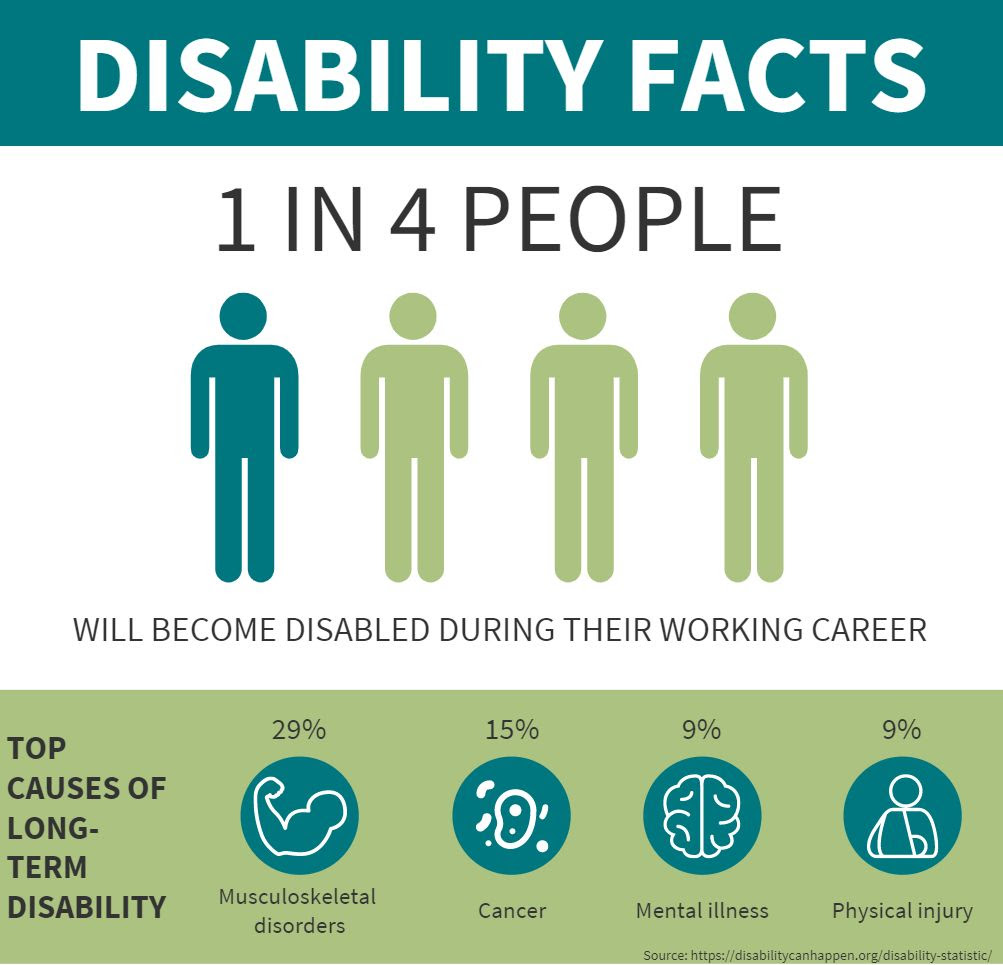

Protect your Lifestyle with Disability Insurance

Some of the most common conditions that keep you from working include pregnancy, arthritis, cancer, and mental health problems. Disability Insurance is designed to replace a portion of your income if you are unable to work due to an accident, injury, or illness. The benefits are paid directly to you, so you can spend it how you need to.

Call Us 469-717-3607

Email: customerservice@swdmg.com

Amy Bogda 469-296-8851 Carla Huggins 469-660-2882

Rachel Bridgewater 469-717-6165 Julie Walker 469-532-0064

Protect Your Lifestyle With Disability Insurance

Disability? No, not me!

This is what most people think, but life is unpredictable. Some of the most common conditions that keep you from working include pregnancy, arthritis, cancer, and mental health problems. Disability Insurance, also known as Income Replace Insurance, is designed to replace a portion of your income if you are unable to work due to an accident, injury, or illness. The benefits are paid directly to you, so you can determine how the money is spent to best meet your needs.

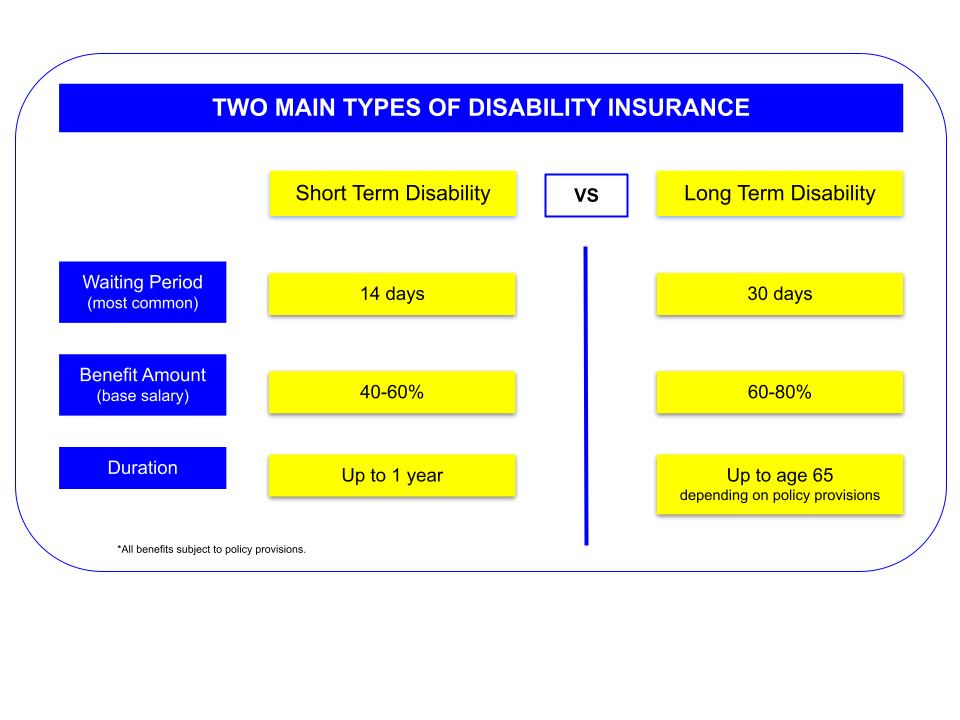

There are two types of disability insurance, short term and long term. The biggest difference between the two is the period of time you’ll receive benefits if you’re unable to work.

Our team of licensed professionals can help you determine what level of coverage you would need if you became disabled.

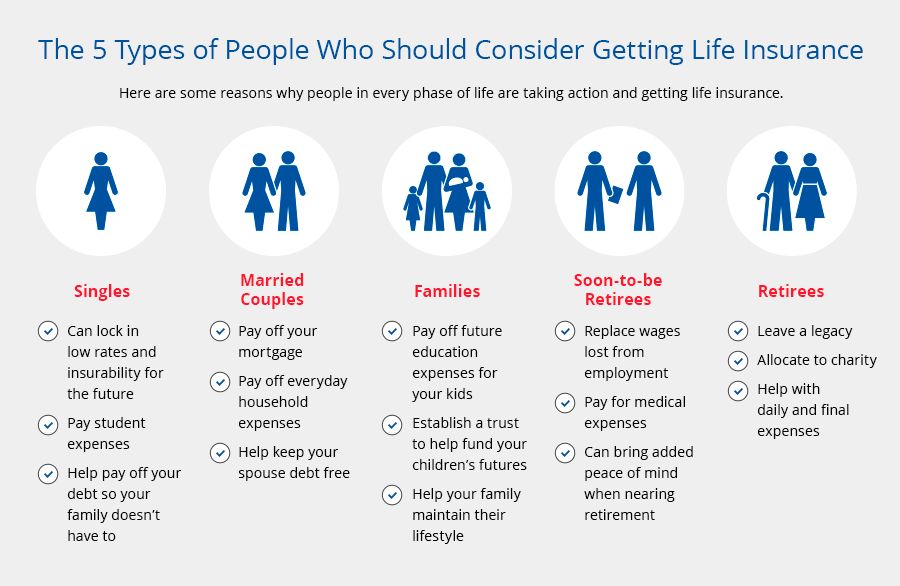

Who Needs Life Insurance?

Who Needs Life Insurance?

If you are unsure, ask yourself this question:

Does anyone in my life benefit from or need my financial support?

Life insurance is one part of having a sound financial plan at any stage of life and has become even more important during the COVID-19 pandemic. It is meant to protect your family and loves ones, pay off debts and other expenses, add more financial security, and bring peace of mind.

Depending on the type of policy, it is fairly inexpensive even if you're not in prefect health. Our licensed professionals can help you determine which type of policy and how much coverage is right for you or you can apply now below.

10, 15, 20, 25, 30 year level term

$50k - $1.5M in coverage*

No medical exam (No Blood Work or Urine)

Approval Decision in 10 minutes

*Higher coverage amounts are available through our licensed professionals

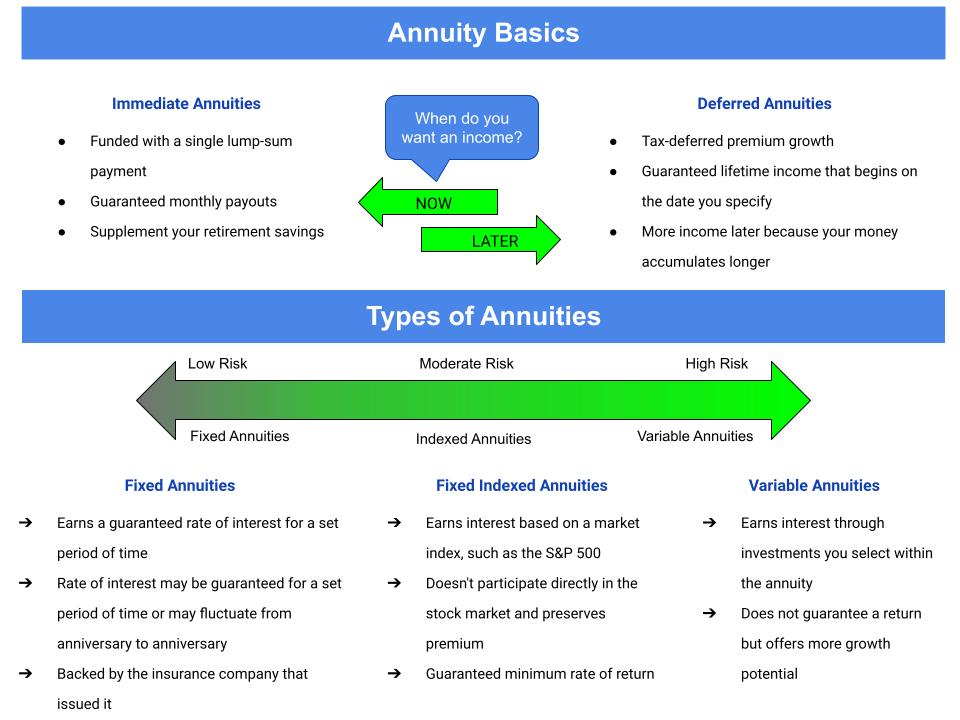

Annuities

Even though annuities are most often considered financial solutions for older people who are close to retirement, annuities can benefit investors of any age with a variety of financial goals.

Reasons to buy an annuity include:

Long-term securityTax-deferred growthPrincipal protectionProbate-free estate distributionInflation adjustmentsDeath benefits for heirsSome annuities can be optimized to help pay for long-term care